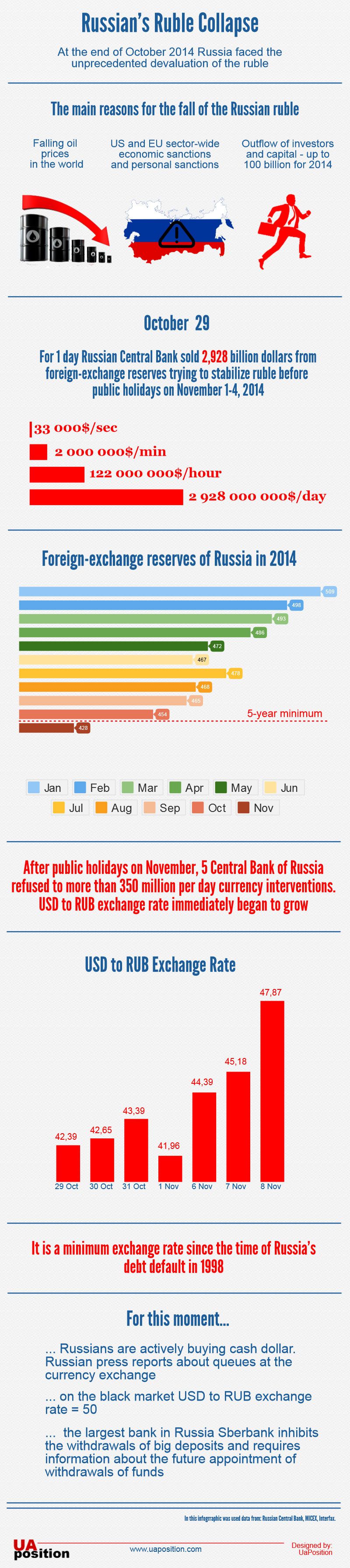

At the end of October 2014 Russia faced the unprecedented devaluation of the ruble

The main reasons for the fall of the Russian ruble:

- Falling oil prices in the world

- US and EU sector-wide economic sanctions and personal sanctions

- Outflow of investors and capital – up to 100 billion for 2014

For 1 day Russian Central Bank sold 2.928 billion dollars from foreign-exchange reserves trying to stabilize ruble before public holidays on November 1-4, 2014.

That means Russian Central Bank has been spending foreign-exchange reserves:

- 33 000$/sec

- 2 000 000$/min

- 122 000 000$/hour

- 2 928 000 000$/day

Foreign-exchange reserves of Russia in 2014 reduced from 509 billion USD to 428 billion USD.

It is a five-year minimum since October 16, 2009

After public holidays on November, 5 Central Bank of Russia refused to more than 350 million per day currency interventions. USD to RUB exchange rate immediately began to growth to 47.9 rubles per dollar.

It is a minimum exchange rate since the time of Russia’s debt default in 1998.

For this moment we see ruble panic in Russia:

- Russians are actively buying cash dollar. Russian press reports about queues at the currency exchange

- on the black market USD to RUB exchange rate = 50

- the largest bank in Russia Sberbank inhibits the withdrawals of big deposits and requires information about the future appointment of withdrawals of funds

This infographics can be distributed and reposted under a Creative Commons license with linking to uaposition.com