Western countries fought so vigorously against “oil” dictators in Iraq, Iran, Libya, and Venezuela that they failed to notice the biggest one right under their noses.

The USA, UK, and EU not only bought Russian oil and gas for decades but also built pipelines, displacing other importers in favor of the Kremlin, and helped the latter to acquire extraction and transportation technologies.

On the second year of the major energy sanctions against Russia, there are countless gaps, not just loopholes. The imposed oil embargo and price restrictions on black gold are not fully effective, and natural gas remains completely unaffected by sanctions.

The sanction standoff increasingly resembles a race in which the winner will be the one two steps ahead of the opponent. The outcome of this competition is evident: Russia maintains its main source of income, and the energy sanctions have no impact on the Kremlin’s desire to end the conflict.

Sanctions were late twice

Until 2014, the servicing of deep oil and gas wells in Russia was largely dependent on four American companies. As disclosed by a former employee of Halliburton’s Russian division, they sometimes had to complete complex wells with the help of local contractors because they couldn’t handle it alone.

Thus, it was possible to put pressure on Russians as early as 2014 by forcing these companies to leave Russia. However, there was a lack of political will to do so. The imposed sanctions proved to be insufficiently strong to cause significant damage to Russia, but they were enough to make the Kremlin prepare for truly serious blows.

After the annexation of Crimea, Russians immediately launched an import substitution program. In 2014, their capabilities could provide only 20% of the required equipment for well processing, and by 2019, it increased to 50%. American companies continued to process Russian wells and cultivate drilling specialists in Russia through modern training centers.

Source: Economichna Pravda

Western companies also helped Putin’s regime master liquefied natural gas (LNG) technologies, allowing Russia to transport gas by tankers worldwide and reduce its reliance on pipelines to the EU. The largest LNG projects in Russia, Sakhalin-II and Yamal LNG, were realized thanks to Western technological licenses. Shares in these projects were purchased by French, British, and Japanese companies.

Until 2022, Western countries supplied equipment and materials for oil processing. Annual contracts worth billions of dollars helped modernize Russian oil refineries and strengthen their positions in this market.

After the occupation of Crimea, the European Union not only continued oil and gas supplies from Russia, but increased them. From 2014 to 2019, the EU’s dependence on Russian gas imports increased from 37% to 45%.

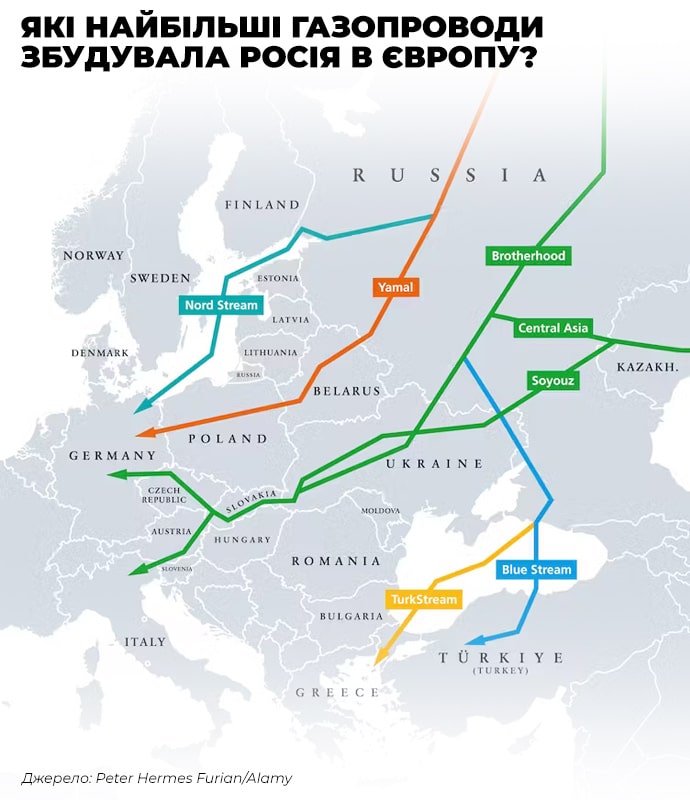

Thanks to its lobbyists, Moscow managed to build a network of controlled gas pipelines in the EU and make buyers forget about the war in Ukraine. Eventually, Russian gas was made a part of the EU’s “green course”.

Source: Peter Hermes Furian/Alamy

The EU, Britain, and the USA essentially gifted the aggressor with windfall profits. In the years leading up to the full-scale invasion, the Kremlin set aside a portion of these funds in the National Wealth Fund (NWF). During this time, the fund accumulated a volume of $183 billion. Currently, the NWF is used to finance the production of weapons and provide payments to the military.

Even after blatant crimes under the Russian flag, Western countries did not cease feeding Putin’s regime. Oilfield service company Schlumberger continues to drill complex Russian wells, Japanese firms are still involved in the Sakhalin-ll LNG project, and no sanctions have been implemented on gas supplies.

Even the oil embargo was postponed for a year, and an exception was made for one branch of the Druzhba oil pipeline.

The results of such partial sanctions are conflicting. On one hand, Russian budget revenues from oil and gas sales in May 2023 fell by 38% to 570 billion rubles. On the other hand, comparing it with 2022 is not entirely fair, as oil and gas prices were at historic highs then. Despite the loss of windfall profits, Russia still has enough money to finance the war. The federal budget deficit in June exceeded the annual plan and amounted to 2.6 trillion rubles. However, the Kremlin does not pay much attention to this, as the National Wealth Fund (NWF) can cover this amount several times over.

Russian oil found its place

Despite optimistic forecasts by analysts for the world, oil production in Russia has only decreased by 5% since the start of the full-scale war. It turned out that there are buyers for Russian crude oil. Throughout 2022, while the G7 embargo was not yet in effect, Russians were looking for new customers. As a result, a partial exchange of markets occurred: Russian oil went from Europe to Asia, and Middle Eastern oil went from Asia to Europe.

For Russia, such a reorientation came at a high cost. The delivery time for oil from certain ports increased threefold, resulting in higher logistics costs. To displace competitors and compensate clients for sanction risks, Russia had to sell oil at a discount.

Russian Urals crude oil has been sold at a discount to the benchmark Brent since the start of the full-scale invasion. This discount, ranging from 20 to 30 dollars per barrel, prevented Russia from earning additional tens of billions of dollars during the war in Ukraine.

Western policymakers hoped that global oil prices would soon plummet, causing the value of the Urals to drop even further, and pushing the Russian budget into deep deficit. However, reality turned out differently.

The deeper Russian oil penetrates the Asian market, the smaller the discount relative to Brent becomes. At the beginning of the invasion, the discount was $37 per barrel, but now it is $19. Over the last five months, the gap has narrowed by 40%.

World prices are not falling because Saudi Arabia artificially reduces production and maintains oil prices at a high level. The combination of rising global prices and a reduction in the discount led to a 35% increase in the price of a barrel of Urals crude oil since March. Currently, the average price of Russian oil is $67 per barrel, essentially returning to the level of December 2022 when no oil sanctions were in effect.

This situation has led to another problem: Russia is increasingly selling oil above the defined price threshold that came into effect in the winter. Under the new rules, tankers lose Western insurance policies if the price of Russian oil in the contract exceeds $60 per barrel.

Therefore, G7 countries sought to maintain access to Russian oil while preventing the Kremlin from profiting from it. However, over the past year and a half, Russia has created a shadow tanker fleet using old 15-year-old vessels, insured by questionable companies, Russia itself, or its partners.

This fleet has the ability to transport oil bypassing Western restrictions. According to calculations by the Kyiv School of Economics (KSE), Russia can transport half of its crude oil and one-third of its petroleum products using this method.

“It is quite possible that Western transport companies legally carry a portion of Russian oil at the permitted price, while the shadow fleet transports another portion through alternative routes at higher prices,” said Boris Dodonov, an analyst at KSE.

According to him, price restrictions only apply to vessels departing from Russian ports. If Russians resell their oil in the Black Sea to another trader and transfer the cargo to another vessel, sanctions will not apply to that vessel, and the Russian oil will smoothly sail to the customer.

“Most often, Russians simply manipulate the price in the documents. For example, the customer pays three times more for transportation than is actually spent on logistics. This means that part of the money goes into the pockets of traders associated with Russian companies, while on paper, the price remains at $60 per barrel,” emphasized Dodonov.

According to KSE research, since the introduction of price restrictions, 16% of Russian oil has been sold at prices higher than $60 per barrel.

See also: 500,000 euros for avoiding sanctions. How law firms in Europe help Russians

The situation with petroleum products is even more complicated. Premium fuels such as gasoline and diesel have a price limit of $100 per barrel. Over the past few months, the market price has not exceeded this threshold. Therefore, Russia has not lost anything from this price restriction.

Gaps in the sanctions allow not only the disregard of price restrictions but also the embargo imposed by G7 countries in the winter. The Monitoring Group of the Institute of Black Sea Studies and Blackseanews publication found that European companies systematically import Russian crude oil and petroleum products. Since the beginning of 2023, the group identified 40 tankers violating the embargo on crude oil and 67 on petroleum products.

Dodonov believes that it is possible to close all these gaps in the sanctions. To start, the price threshold for Russian oil and petroleum products should be lowered. According to KSE calculations, reducing the price of Russian oil by just $10 per barrel deprives the aggressor of $10 billion in annual revenue.

The mechanism for limiting prices needs to be enforced. According to Dodonov, G7 countries are not closely monitoring market players, even though they should conduct investigations, especially regarding newly established companies transporting Russian oil. This should go hand in hand with stricter requirements for providing documentation on contracts with Russia.

Sanctions against violators of the mechanism can be stricter, including asset freezes and bans on transporting any oil worldwide. In the end, the West can prohibit the passage through dangerous straits for old 15-year-old tankers, which mostly transport Russian oil.

Gas is not under sanctions

Russians don’t need to bypass sanctions on gas because there are virtually none. In 2022, the United States surpassed Russian pipeline supplies to Europe for the first time with liquefied natural gas (LNG). However, this happened at the will of Russia, which reduced its deliveries. The European Union began to seek alternatives, build LNG terminals, and fill gas storages. There has been some success in this regard, but the bloc still lacks 30 billion cubic meters of gas per year to get through the winter. It will be imported from Russia.

Russia continues to operate the TurkStream gas pipeline, natural gas transmission system of Ukraine and the LNG terminals through which natural gas is delivered to the EU. According to the research by National Interests Advocacy Network ANTS at the current rates, Russia can supply 26.5 billion cubic meters of gas to the European Union in 2023.

This is five times less than before the invasion; however, the average price has increased since then. As a result, Gazprom manages to replenish the Russian budget with 100-150 billion rubles monthly.

Even if pipeline supplies eventually cease, Russia will retain significant capacities for exporting liquefied natural gas, which can be delivered to any part of the world. According to Reuters, in 2022, Russia sold 45 billion cubic meters of LNG, with half of it going to European ports. This was 20% higher than the 2021 figure. In the future, Russia plans to increase its LNG terminal capacities and become the fourth-largest LNG exporter in the world.

“Global natural gas consumption is increasing, and soon it will occupy the second position after oil in the list of the most demanded energy resources. It is considered relatively environmentally friendly and easier to use compared to other fossil fuels. Natural gas is also an important raw material in the production of plastics and fertilizers, the demand for which is constantly growing. Interest in Russian gas will persist in all markets where it can be delivered. Therefore, it is not reasonable to assume that the reduction of natural gas imports from Russia is irreversible,” noted Oleg Karyy, an economist and professor.

If Western countries do not impose a ban on Russian gas and do not strengthen restrictions on Russian oil, they will sooner or later return to using bypass routes, undoing all the progress made in the last one and a half years.

Originally posted by Bohdan Miroshnychenko on Economichna Pravda, translated and edited by the UaPosition – Ukrainian news and analytics website